Meet out New Member Apex Partners

Through a strong proprietary distribution capacity, we offer structured products for the Brazilian regional markets, where capital is allocated. Today, the company is present in Espírito Santo, Paraná, and Santa Catarina, where it has established offices and more than 150 employees aligned with a unique culture.

In recent years, we have expanded around our core operations, building a resilient thesis even in the face of the challenging economic cycles faced by Brazil in the last decade. All this because we decided to explore the potential of the Brazilian regional markets, especially in states that have grown – significantly – above the national average.

The coming years will be even more promising. The path that will lead to becoming the leading Brazilian regional investment bank by 2030 is increasingly guided by a unified regional structure, always maintaining a commitment to the excellence and success of our clients.

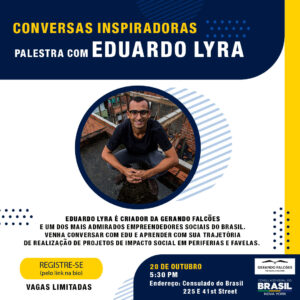

Join us in our mission to raise critical funds by purchasing tickets or making a donation.

Don’t miss out on our online silent auction, closing at 10pm on May 13th.

When

Monday, May 13th

Cocktails 6pm

Seated Dinner 7pm

Where

230 Fifth Rooftop

At 1150 Broadway

New York, NY 10001

Dress Code

Business Casual

———————————————————

For any questions, please reach out to us at donorservices@gerandofalcoes.com.

Thank you for your continued support!

Via Gerando Falcões

“The extraordinary efforts of Cushman & Wakefield to hire, retain and support veterans and the military-connected community have earned the organization one of our highest awards,” said George Altman, President of VETS Indexes

This year, a record 344 organizations submitted completed surveys for the VETS Indexes Employer Awards, an increase of more than 100 from last year and nearly triple the number from two years ago. Of those, VETS Indexes recognized 285 organizations across the following award levels: 5 Star Employer, 4 Star Employer, 3 Star Employer and Recognized Employer.

This in-depth survey and recognition program analyzes employers’ policies, practices and outcomes in detail, across the following 5 categories:

For more information, click here.

Via Business Wire

Its financial growth was particularly remarkable during the pandemic, as the litigation powerhouse targeted growth across the energy, food and beverage, and health care sectors when other industries were stagnant, according to one analysis.

The Atlanta-founded firm steadily increased its revenues over the years before breaking the $2 billion mark in 2022—and will top that mark and other metrics in 2023, said longtime chairman Robert Hays in an interview this month. The firm’s revenue growth has consistently beaten the Am Law 100 collective growth rate each year for the past several years.

King & Spalding has expanded in major U.S. markets like New York and in growing international regions like Saudi Arabia throughout the year, said Hays, who has served as chairman since 2006 and was reelected earlier this month (January, 2024).

King & Spalding beat out seven other firms for the Best Law Firm of the Year award and also won awards for Attorney of the Year (Sally Yates), and Best Client-Law Firm Team (King & Spalding and Blackstone Credit). It was a finalist for Managing Partner of the Year (Robert Hays), Best Provider Collaboration, Litigation Department of the Year for Product Liability, and Georgia Litigation Department of the Year.

The report also stated that “energy was the only bright spot” in the stagnant economy during the pandemic and King & Spalding was among firms that “made sustained investments in talent depth and market reputation” in that sector.

Hays, in the interview, cited an award factor mentioned during the presentation ceremony in New York: the firm’s history in recent decades of moving from being a regional firm to a “national

and global firm.”

King & Spalding expanded from its “flagship” Atlanta office in 1989, to 13 U.S. and 10 foreign offices with more than 1,300 lawyers today, according to firm information.

In 2023, after years of operating offices in the United Arab Emirates, the firm’s longtime affiliation with a local firm led to Saudi Arabia’s Ministry of Justice awarding King & Spalding a foreign law license.

Mattos Filho has announced seven lawyers have been promoted to the firm’s partnership. The new partners work across six different practice areas: Litigation & Arbitration, Finance, Asset Management Services & Investment Funds, Infrastructure & Energy, Corporate/M&A, and Tax.

With a keen eye on the demands of the most diverse sectors of the economy and the needs of the market, the promotion of lawyers follows the strategy of expanding business development, as well as generating opportunities and developing internal talents.

Six of the seven new partners are women. In the last five years, internal partner promotions at the firm have been practically even in terms of men (31) and women (29) – 52% and 48%, respectively. This statistic reflects Mattos Filho’s push to offer equal opportunities and develop female leadership at the firm.

Via Mattos Filho

Azul is Brazil’s largest carrier by number of flights and destinations served. Founded in 2008 by David Neeleman, the carrier has grown rapidly and become the airline many Brazilians consider the best in the nation. Compared to LATAM Brasil, its international long-haul operations are limited, with only four cities served: two in the United States and two in Europe.

The airline announced that from June 5, it would be resuming flights from its hub at Aeroporto Internacional de Recife-Gurarapes to Orlando International Airport and Fort Lauderdale-Hollywood International Airport. Flights were suspended last month due to capacity restraints with its widebody fleet, but with the acquisition of new (to the airline) aircraft, Azul can resume flights just three months after suspending them.

Unlike most routes from the United States, where aircraft remain on the ground in Brazil for the entire day before flying back to the US overnight, Azul will fly to the US during the day, and its return legs will operate overnight.

Reporting by Lukas Souza via Simple Flying

Combining Accenture’s data, AI, and platform engineering expertise with BNY Mellon’s comprehensive financial data and analytics services will help accelerate the introduction of new services across private markets and wealth management technology, as well as support expansion into new markets. With the expertise and platforms to help clients achieve their goals, BNY Mellon will also work with Accenture to create exceptional client experiences. The two companies plan to further collaborate on bringing the newly developed services to market in the future to transform the financial services industry.

The collaboration of Accenture and BNY Mellon is the latest announcement by BNY Mellon as part of its technology and ecosystem strategy focused on building new solutions to help its clients grow their businesses. BNY Mellon’s Data & Analytics business recently announced a strategic alliance with Microsoft, focused on transforming the capital markets through leading data management solutions for its buy-side and sell-side clients.

About BNY Mellon

BNY Mellon is a global financial services company that helps make money work for the world — managing it, moving it and keeping it safe. For 240 years we have partnered alongside our clients, putting our expertise and platforms to work to help them achieve their ambitions. Today we help over 90% of Fortune 100 companies and nearly all the top 100 banks globally access the money they need. We support governments in funding local projects and work with over 90% of the top 100 pension plans to safeguard investments for millions of individuals, and so much more. As of December 31, 2023, we oversee $47.8 trillion in assets under custody and/or administration and $2.0 trillion in assets under management.

By Jessica Thomas via BNY Mellon

The cureless disease has partly damaged trees in Brazil and destroyed most of them in the United States, causing orange juice prices to skyrocket.

The government of Mato Grosso do Sul, in Brazil’s center-west, said the company will plant 5,000 hectares with oranges in the town of Sidrolandia, according to a statement late on Wednesday.

Mato Grosso do Sul said Cutrale is expected to plant 1.73 million orange trees on irrigated fields there, adding in the future the company could set up a processing facility in the area.

Cutrale confirmed to Reuters it “met with the government of Mato Grosso do Sul to discuss investments in the region’s citrus industry.” But the company added it could not elaborate on the tentative project, making the timeline for implementation of the fields unclear.

Reporting by Roberto Samora; Writing by Ana Mano; Editing by Aurora Ellis via Reuters

O Banco Master anunciou, na sexta-feira (23/02), a aquisição do will bank, banco digital que conta com mais de seis milhões de clientes e forte presença no Nordeste. Com a negociação, o Master passa a ser majoritário no banco digital, que tem também o fundo de private equity da XP como sócio.

Desta forma, o Banco Master passa a atender mais de 10,5 milhões de clientes e espera expandir a base do will bank, oferecendo cartão de crédito, seguros e outros serviços, de acordo com o comunicado enviado pela companhia ao mercado.

“Com a aquisição do will bank, passamos a ter um ecossistema digital completo, com tecnologia robusta e capilaridade na distribuição de produtos financeiros”, afirma Daniel Vorcaro, Presidente do Banco Master.

Via Forbes

With the aim of expanding its connectivity in the important Brazilian market, starting from June 25, Copa Airlines will fly to the city of Florianopolis, the capital of the state of Santa Catarina in southern Brazil. Known as the “Island of Magic” for its more than 100 stunning beaches with crystal-clear waters and white sands, this city offers a rich culture and Azorean architecture, along with natural diversity encompassing ecotourism, trails, and natural parks. Considered one of the friendliest capitals in the country, Florianopolis is a true paradise for surfing enthusiasts.

The city of Florianopolis becomes the seventh destination for the airline in Brazil. Copa Airlines’ flight to Florianopolis will initially operate with three weekly frequencies on Tuesdays, Thursdays, and Sundays. Departing at 3:23 p.m. from Panama (local time) and arriving at Hercilio Luz International Airport at 12:22 a.m. (local time). The return flight will depart from Florianopolis at 1:25 a.m., reaching Panama at 6:30 a.m. (local time) on Wednesdays, Fridays, and Mondays.

Passengers interested in traveling to or from the cities of Tulum, Florianópolis, and Raleigh-Durham can make their reservations at www.copa.com, sales offices, and the call center.

Maintaining its leadership in the region, Copa Airlines was recognized by the renowned company Cirium as the “Most Punctual Airline in Latin America in 2023,” achieving an on-time arrival rate of 89.46% and an on-time departure rate of 91.71% for the year. This recognition, placing us among the top 3 most punctual airlines globally, has been awarded by Cirium on nine occasions.

Via Aviator

White & Case is ranked #2 overall, and in the top three in the following categories:

Tim Hickman, partner and head of the Firm’s Data, Privacy & Cybersecurity practice, said: “These rankings reflect our commitment to helping clients successfully navigate complex AI, data, and cyber challenges around the world.”

GDR’s profile of White & Case described the Firm’s “ability to handle complex work spanning multiple jurisdictions for some of the world’s most demanding clients” and “cross-industry excellence.” One client noted the team’s “outstanding performance,” while another said, “The responsiveness of the partners and the pragmatic advice really sets them apart.”

Via White & Case

A gigante do varejo brasileiro aposta no mercado de infraestrutura de nuvem desde 2021, mas só no ano passado abriu os serviços para consumidores. Até o momento, há cem clientes PJ e cerca de 700 pessoa física — todos vindos por indicações e redes de contatos do Magalu, explica Christian Reis (Kiko), diretor da Magalu Cloud.

Clientes dos setores de varejo, saúde, tecnologia e industrial já utilizam o serviço de nuvem desde o ano passado, mas esta é a primeira vez que o Magazine Luiza passa a oferecer a plataforma ao público em geral. Para isso, a empresa acelerou investimentos, reforçou as operações de software e realizou testes de carga para atender a demanda.

Agora, com o início da oferta ao público em geral, a Magalu Cloud se diz pronta para atender o mercado e para ampliar sua participação no setor. Os serviços passam a ficar disponíveis a partir de hoje ao público em geral e podem ser contratados pelo site. A plataforma é voltada tanto para desenvolvedores quanto startups e empresas de maior porte.

O Magalu Cloud está lançando três serviços: um de armazenamento de dados escalável (object storage), uma solução de gerenciamento de contas corporativas e colaboradores, fornecedores ou terceiros (chamado Turia IAM) e outra de autenticação integrada, em que o usuário acessa diversos serviços online por meio de uma conta única (ID Magalu).

Uma das estratégias para acelerar o crescimento do negócio foi firmar uma parceria com a Dell na frente de object storage e assim já chegar a mais clientes. A ideia é que os clientes da Dell passem a aproveitar o Magalu Cloud para fazer backups de volumes grandes de dados ou transferir novos dados para a plataforma, otimizando o tempo que uma máquina física própria de armazenamento exigiria.

A Dispatched, que é considerada uma modern advisory firm (empresa moderna de consultoria), promove para seus parceiros uma minimização dos custos e o afastamento dos riscos ao se estabelecer empresas nacionais em território dos Estados Unidos ao simplificar as etapas de lançamento e expansão das empresas em todas as etapas, por meio de um conjunto de serviços e de networking que proporcionam a capacitação dos empreendedores, para que estes tenham uma maior assertividade e sucesso na realização de seus objetivos.

Por Analice Nicolau via Jornal de Brasília

From financial situations through to capital markets, regulatory and public affairs, social issues, crisis, cyber, employee engagement and litigation, clients rely on Brunswick for insight, advice, preparedness and campaigns.

Love Together Brasil is a non-profit, non-governmental organization based in Piancó, Paraíba.

The idea to establish Love Together Brasil was born in 2014, inspired by Geralda Sarraf, a native of Piancó who lives in New York, and her American friend Kristen Campagna.

The idealism and altruism of the friends became a reality, with the help of friends and volunteers, starting in April 2015, when Love Together Brasil, officially established, began its work in underprivileged communities in the hinterlands of Paraíba.

The goal of Love Together Brasil is to carry out, with the support of volunteers and the partnership of companies and public and private institutions, specific actions in education, health, and water supply.

In the last three years, the activities of Love Together Brasil have been intensified to alleviate the problem of water scarcity in underprivileged communities in the Northeast region, notably in Paraíba, with the drilling/installation of artesian wells in Daycares, Schools, Hospitals, and Urban and Rural Communities, through the “WATER FOR THOSE WHO ARE THIRSTY” Project, benefiting thousands of people.

Through this project, with the help of donors and volunteers, Love Together Brasil has delivered 50 (fifty) artesian wells, contributing to improving the living conditions of approximately 150,000 people in the Metropolitan Region of the Vale do Piancó, which covers 18 (eighteen) municipalities in the hinterlands of Paraíba.

In addition to carrying out specific actions in Education and Health, our mission is to bring potable water to underprivileged communities in the northeastern hinterland, promoting the socioeconomic development of regions affected by frequent droughts, intense heat, and water scarcity.

Dispatched Business Studio is a platform of trusted advisors working in collaboration with businesses, brands, and innovative founders. This new model of an advisory firm provides curated business solutions that tap into a unique network of experts across a broad range of industries in the US and internationally.

Dispatched’s mission is to simplify and elevate the process of launching and expanding companies at all stages by delivering a comprehensive suite of services, expertise, and connections that empower entrepreneurs, innovators, brands, and investors to strategically accelerate.

The definition of ‘dispatch’ is to send off purposefully and to deal with tasks efficiently, which reflects the founders’ inherent ability to rapidly organize complex projects and manage tasks and teams through a detail-oriented approach.

Fabiola Ordonez and Rodrigo Castello Branco are creative former practicing attorneys with multicultural backgrounds and entrepreneurial mindsets who practiced law at major international firms and the world’s largest asset manager. With over fifteen years of combined experience, they have structured, led, negotiated, and closed countless transactions amounting to billions of dollars in deal value for private and public companies across various industries.

Based in New York, with personal and professional experiences spanning the Americas, Europe, and Asia, they bring a fresh and dynamic approach to the ‘square’ stereotype of advisory firms. Fabiola and Rodrigo identified a gap in clients’ needs for bespoke and efficient business services and guidance outside of law – a true handholding. With that in mind, they departed from the practice of law to create this new concept of a ‘business studio’, where they offer a “one-stop shop” model to US and LatAm based clients.

Via AP News

Tarciana Medeiros, presidente do Banco do Brasil, está entre os CEOs e empresas que conquistaram o Prêmio Ambição 2030 da ONU (Organização das Nações Unidas).

Na sua primeira edição, o prêmio reconheceu iniciativas de inclusão étnico-racial e equidade de gênero e foi anunciado na quinta-feira (14/03) em evento na sede da ONU, em Nova York.

Tarciana foi premiada como CEO de destaque com as iniciativas “Raça é Prioridade” e “Elas Lideram”, que têm como objetivo alcançar a paridade de pessoas negras e de mulheres na liderança, respectivamente, até 2030. “A diversidade é questão central da nossa gestão e temos conquistado importantes resultados tanto para equidade de gênero como para a inclusão da população preta e parda”, diz a CEO.

Desde que assumiu, em janeiro de 2023, a presidenta, como gosta de ser chamada, tem levantado pautas de diversidade e sustentabilidade dentro do banco mais antigo do país, com 215 anos.

Sob sua gestão, o banco estabeleceu metas públicas e concretas em sustentabilidade e inclusão, criou um comitê de diversidade e tornou-se embaixador dos compromissos da ONU. “Essas ações priorizadas na estratégia do BB têm demonstrado impacto positivo para clientes, funcionários, fornecedores e demais parceiros estratégicos, contribuindo para a inclusão financeira e a geração de trabalho e renda.”

Para além do discurso e dos resultados financeiros que vem trazendo, Tarciana Medeiros levou mais mulheres para a diretoria e um executivo negro para liderar a BB Asset Management.

O Banco do Brasil também foi homenageado por suas medidas dedicadas à promoção da igualdade de gênero e inclusão étnico-racial. A instituição está presente na premiação nas categorias “30% de pessoas negras ou indígenas em posição de liderança até 2025” e “Apoio ao empreendedorismo de mulheres através das cadeias de suprimentos e marketing, com implementação de práticas de desenvolvimento empresarial que empoderem as mulheres”.

Via Forbes Brasil

TOLL

MAYA AND THE WAVE

Register for free on our platform

Via Inffinito

This recognition highlights our commitment to good practices in governance, transparency, communication, and funding.

Thank you to everyone supporting our cause for a better Brazil!

Via BrazilFoundation

O Mattos Filho recebeu o principal prêmio do Chambers Brazil Awards 2024: Brazil Law Firm of the Year. É a sétima vez que o escritório é reconhecido como o melhor do ano no país, o que o torna recordista nesta categoria. Durante a cerimônia, realizada no último dia 21/3, em São Paulo, o Mattos Filho recebeu outros quatro reconhecimentos, sendo o líder em número de premiações desta edição.

O Chambers Brazil Awards é uma das principais premiações do mercado jurídico e reconhece os escritórios de advocacia do país por sua excelência técnica, atendimento ao cliente e crescimento estratégico. Para o Mattos Filho, esse resultado reflete o trabalho estratégico dos profissionais no atendimento jurídico de excelência que é prestado aos clientes.

Via Mattos Filho

Finocchio & Ustra (FIUS) is a full-service law firm, with a team of approximately 250 people. FIUS has a relevant history of success cases resulting from its strategic way of acting and business acumen. Focused on understanding and improving its clients’ businesses, the firm places the client at the center and harnesses multidisciplinary efforts to mitigate risks and deliver strategic, innovative, reliable and effective solutions. The team is its best asset, and FIUS is incredibly proud to have an extremely talented team that acts freely in an ethical and collaborative environment. The firm’s core values are based on respect, innovation, excellence, and preparing for coming corporate challenges. Headquartered in Campinas for 22 years, with branches in Ribeirão Preto, São José dos Campos and São Paulo, FIUS has a strong presence in the countryside of the state of São Paulo, as well as correspondents throughout Brazil and abroad.

A PwC Brasil e a Fundação Dom Cabral (FDC) têm o prazer de anunciar sua parceria para o desenvolvimento de um dashboard personalizado que revela o índice de Transformação Digital através do ITDBr!

O ITDBr é um índice nacional que mensura e analisa os avanços, percepções e perspectivas sobre os principais pilares corporativos que impulsionam a transformação digital. Ele oferece dados personalizados para grandes e médias organizações, além de startups em diversas indústrias no Brasil.

O público-alvo desta pesquisa são os gerentes e cargos superiores das áreas de tecnologia, TI, inovação ou transformação digital.

Como forma de agradecimento pela participação, os participantes receberão em primeira mão os resultados da pesquisa e terão acesso ao dashboard exclusivo para análise de seu posicionamento. Esta é uma oportunidade única de obter insights valiosos sem custo adicional.

O preenchimento do questionário pode ser realizado até o dia 22/03 e leva menos de 20 minutos para ser concluído.

Não deixem de participar! Juntos, estamos impulsionando a transformação digital no Brasil.

| Capital Markets | Brazilian Authority Updates Rules For Eligible Underlying Assets of CRI and CRA; Reimbursement of Expenses Remains Restricted

The National Monetary Council (CMN) promoted specific adjustments to regulation that substantially impacted the offering of Agribusiness Receivables Certificate (CRA) and Real Estate Receivables Certificate (CRI) by agribusiness and real estate related companies, respectively. See below the changes that Resolution No. 5,121, of March 1st, made to Resolution No. 5,118: 1. The Definition of “Debt Instruments” Does Not Include Commercial Contracts: The wording of Resolution 5.118 generated doubt among market agents whether or not it included contracts of a commercial nature, which are common in securitization transactions. The CMN clarifies, through Resolution 5.121, that contracts of a commercial nature, such as rental contracts, purchase and sale contracts and usufruct contracts related to real estate, can be used as underlying asset for CRA and CRI offerings. 2. Possibility of Issuing CCI as Backing for CRIs: The revised regulation now allows debt instruments whose issuers are not characterized as debtors, co-debtors or guarantors to also be backed by CRA and CRI, such as the Real Estate Credit Certificate (CCI), which is a title issued by a real estate lender. 3. Prohibition of Backing with Debt Instruments of Financial Institutions: Another amendment to Resolution 5.118 sought to restrict the application of the new prohibitions to financial institutions or their respective subsidiaries. 4. Possibility of CRI Offerings for Reimbursement of Expenses Remain Prohibited: One of the points that market agents expected that the CMN would review was regarding offering of CRI for reimbursement of expenses. Resolution 5.121 did not change the restriction imposed by Resolution 5.118 that CRAs and CRIs cannot contain as collateral credit rights “arising from financial operations whose resources are used to reimburse expenses”. Although the changes introduced are welcome, the CMN should have also allowed the possibility of CRI for reimbursement of expenses, which is a typical real estate transaction and brings liquidity to the sector. |

| Dispute Resolution | New “Electronic Judicial Domicile” System in Brazil: Mandatory Registration of Brazilian Companies Must Be Completed by May 2024

According to the Brazilian National Council of Justice (CNJ), registration is mandatory for all companies that are registered in Brazil (i.e., that have a taxpayer number, so-called “CNPJ”), except if they are classified as “micro” or “small” company. Such registration must be completed by May 30th, 2024. After such deadline, (i) inclusion will be automatic, based on Brazilian Federal Revenue data, (ii) all procedural communications sent via Electronic Judicial Domicile will be deemed acknowledged and valid, (iii) the company will be exposed to penalties and procedural sanctions for non-compliance with such judicial communications (including default of appearance and possible convictions) and (iv) if the company does not use the portal and/or does not respond to procedural communications, a fine will be imposed. The Electronic Judicial Domicile is a platform that concentrates all communications and subpoenas, issued by Brazilian courts and directed to companies, on a single system. It is worth mentioning that the system encompasses all Brazilian courts, regardless of the jurisdiction (for example, civil, federal, labor, tax courts and even superior courts). The purpose of the system is to facilitate procedural communications, standardize access to such subpoenas and expand the digitalization of the Judiciary. As its use will be mandatory, companies must designate an employee/third party to periodically access the portal and train them to operate the platform – so that they perform the filtering and forward such communication to an external lawyer hired by the company. According to the rules of the Electronic Judicial Domicile system, all summonses will be deemed read and valid after 3 business days, and all notifications after 10 business days, starting the procedural deadlines. Also, in case of failure to confirm receipt of the summons, the company will be subject to a fine of up to 5% of the value of the claim. It is important to highlight those communications directed to retained lawyers and/or lawyers already with powers in legal proceedings will not be affected by the new system. The Electronic Judicial Domicile only encompasses communications that are targeted by the Courts directly to companies, as is the case with summonses (i.e., for new claims, in which there is no appointed lawyer yet) or personal subpoenas (in which the communication is made to the party, and not via a lawyer). |

| Labor | Brazilian Superior Labor Court Denies Award Bank Employee Status To Former Employee of Payment Methods Fintech

The 4th Panel of the Brazilian Superior Labor Court (TST) recognized that employees of a fintech of payment methods cannot be equated with bank employees, even if only for the purposes of labor and employment rights. The actions that have reached the TST seek to classify payment method companies in the financial category, in which case the employment contract becomes governed by the collective bargain agreement of bank employees, generally more advantageous, such as, for example, working hours six hours a day (30 hours a week). However, the activities of payment method companies are incompatible with those of financial institutions in the eyes of the Brazilian Central Bank, due to an express legal prohibition. The activity of means of payment is governed by Law No. 12,865, of 2013, which provides for payment arrangements and payment institutions that are part of the Brazilian Payment System (SPB – Brazilian Acronym), which expressly prohibits the performance of these companies in activities carried out by institutions financial institutions regulated by the Brazilian Central Bank. In this case, the Brazilian Regional Labor Court of Rio de Janeiro had understood that the evidence demonstrated that the company acted as a financial company and not just as a payment method company, because in addition to managing credit cards, the company allegedly performed services of “ credit, financing or investments”. The fintech appealed the decision to the Superior Labor Court (TST – Brazilian Acronym), and, for the Reporting Judge of the case at the TST, Judge Maria Cristina Peduzzi, as credit card operators act only as intermediaries between the end user, commercial establishments and financial institutions, which are regulated by the Central Bank of Brazil, payment method companies do not, as a rule, qualify as financial institutions. The Reporting Judger highlighted that “the classification of the activities carried out by the employee as belonging to a (non-financial) payment institution is sufficient to remove the status of a financial institution”, since intermediation and services do not mean that they actually performed the services of financial institutions. We highlight that, fortunately, this decision is in line with the majority understanding of the TST on the subject, which, since 2020, has been taking a position in the sense that employees of fintechs, and other means of payment, act in fact as banking correspondents and cannot be classified as banking or financial institutions, therefore recognizing the regularity of the companies before the Brazilian Central Bank and the absence of labor rights for bank employees to the employees of these companies. |

Programação:

09:00 – 09:20 Abertura/Avisos/Pesquisa

09:20 – 09:35 Palestrante: Gisele Sterzeck (BR)

09:35 – 09:55 Palestrante: Ana Gaertner (BR)

09:55 – 10:25 Palestrante: Eduardo Alves (BR)

10:25 – 10:55 Palestrante: Flavia Fernandes (BR)

10:55 – 11:00 Perguntas e Respostas (Q&A)

11:00 – 11:00 Encerramento

Dispatched Business Studio – a modern take on an advisory firm – offers a one-stop shop approach to LatAm and US based companies looking to enter new global markets or accelerate their businesses in the United States.

Dispatched is a platform of trusted advisors working in collaboration with businesses, brands, and innovative founders. They provide curated business solutions that tap into a unique network of experts across a broad range of industries in the United States and internationally. Implementing their expertise and connections save their clients time and resources, and allows them to focus on their core businesses and passions.

Brazil Transactions – Industry Insights, Winter 2024

Brazil Transactions – Industry Insights, Winter 20241,400 M&A transactions were registered in Brazil in 2023, a 9.3% decrease in the number of announced transactions.

2023 period registered 22 follow-ons, raising over BRL 32 billion (+USD 6.4 bn). For the second consecutive year, there were no IPOs.

Total market capitalization of the Brazilian Stock Exchange (Bovespa) as of December 31, 2023, was over USD 874 bn.

Via KROLL

For more information, please contact:

Alexandre Pierantoni

Managing Director

Head of LATAM and Brazil Corporate Finance

Sao Paulo

+55 11 3192 8103

+55 11 9 5500 8151

alexandre.pierantoni@kroll.com

José Thompson

Director, Corporate Finance

Sao Paulo

+55 11 3192 8108

+55 11 9 8689 4026

jose.thompson@kroll.com

Os desafios de todo tipo enfrentados pelo Brasil chamam a atenção do mundo, gerando comoção entre várias personalidades. A Brazil Foundation, com sede em Nova York e um escritório no Rio de Janeiro, foi criada em 2000 por Leona Forman, após se aposentar de suas atividades na ONU (Organização das Nações Unidas). Na época, com apoio de figuras ilustres, entre elas a antropóloga e pesquisadora Ruth Cardoso (também ex-primeira dama e que faleceu em 2008), Forman fundou a instituição com o objetivo de servir como ponte entre doadores nos EUA e ações afirmativas no Brasil.

Não demorou muito para atrair a atenção de famosos, interessados em fazer doações ao país. A modelo Gisele Bündchen é um exemplo: criou o Fundo Luz Alliance para captar recursos e apoiar iniciativas de preservação e recuperação de rios, mata ciliares e aquíferos. A Brazil Foundation auxiliou Bündchen na aplicação dos recursos, buscando as iniciativas que atendiam aos requisitos da instituição e eram de fato efetivas.

Por Francisco Stefanelli via Forbes Brasil

O Banco do Brasil foi considerado o mais sustentável do mundo pela consultoria Corporate Knights, que avalia o desempenho em sustentabilidade corporativa de cerca de 7.000 empresas de capital aberto mundo afora com receitas brutas acima de US$ 1 bilhão. Foi a quinta vez que o BB foi o banco mais bem avaliado entre as 100 empresas mais sustentáveis. Além disso, pela primeira vez, a instituição figurou entre as dez organizações mais bem colocadas, ocupando a sexta posição.

A avaliação da Corporate Knights leva em conta 25 indicadores econômicos, ambientais e sociais, relativos a receitas e investimentos sustentáveis, promoção da descarbonização, diversidade racial e de gênero.

“Este reconhecimento evidencia nossa atuação consistente no tema ASG sigla para boas práticas ambientais, sociais e de governança. Em 2023, reforçamos ainda mais este nosso trabalho, com a criação de uma Unidade Estratégica para conduzir de modo transversal as pautas ambientais, sociais e de governança no banco”, afirma a presidente do BB, Tarciana Medeiros, em nota. “Temos compromissos públicos e com metas concretas em cada uma dessas frentes, atuando de modo voluntário, protagonista e como verdadeiros líderes em sustentabilidade empresarial no Brasil e no mundo.”

Além das metas e estruturas internas voltadas ao tema, o banco tem uma carteira de R$ 338,2 bilhões em créditos com pegada sustentável. São empréstimos e financiamentos para atividades e setores que têm impactos sociais e ambientais positivos, como energias renováveis, eficiência energética, produção sustentável de alimentos e desenvolvimento local e regional.

“Estamos em um momento em que nossas ações e compromissos para um mundo mais sustentável, conectados aos Objetivos de Desenvolvimento Sustentável da ONU, convidam todos os públicos de relacionamento a assumirem responsabilidades diante das mudanças climáticas e seus efeitos na vida das pessoas e comunidades no presente e no futuro”, diz o vice-presidente de Governo e Sustentabilidade Empresarial do banco, José Ricardo Sasseron.

Via Isto é Dinheiro

A Lei da igualdade salarial é um novo capítulo para a equidade no ambiente de trabalho. Com novas obrigações, a legislação traz janelas de oportunidades para todas as empresas, tendo a compreensão jurídica de suas implicações e o engajamento de lideranças como pilares fundamentais para a adequação à Lei.

No evento ‘Lei da Igualdade Salarial: desafios, estratégias e possibilidades’, nossa sócia Silvia Figueiredo Araújo Schnitzlein e a associada Andressa Gudde recebem especialistas do mercado para apresentar perspectivas e desafios, propondo caminhos para que as empresas estejam preparadas para lidar com todos os possíveis desdobramentos da Lei 14.611/2023.

O time de debatedores é composto por Flávia Lisboa Porto (Reckitt), Marcela Pietrobom (Medtronic), Fernanda Frezarin Kazakevicius [Ela/Ella/She] (Unilever) e Gianfranco Cinelli (Hidrovias do Brasil).

O evento será presencial em São Paulo, no dia 27 de fevereiro, e contará com transmissão online.

Para inscrições e mais informações, acesse: https://bit.ly/3T3urXR

Com Gerson Charchat (sócio, PwC) e Felipe Bovolon (diretor, PwC)

Adicionar o evento no meu calendário

Wed, Feb 21, 2024 9:00 AM BRT

Programação:

09:00 ~ 09:20 Abertura/Avisos/Pesquisa

09:20 ~ 09:50 Palestrante: Felipe Bovolon (Strategy&)

09:50 ~ 10:20 Palestrante: Mauro Toledo (Strategy&)

10:20 ~ 10:50 Palestrante: Gerson Charchat (Strategy&)

10:50 ~ 11:00 Perguntas e Respostas (Q&A)

11:00 ~ 11:00 Encerramento

Speakers:

Via PwC

| On behalf of the Board of Directors of the Brazilian-American Chamber of Commerce, we regretfully inform you of the passing, on February 6, 2024 at the age of 93, of Dario Campos, former Vice Consul of Brazil in New York and longtime Chamber member and supporter. Dr. Campos’ longstanding support of Chamber activities and enthusiastic participation in our programs, well into his 90s, denote his high level of dedication and commitment to the Chamber.

After serving as Vice Consul of Brazil in New York, Dr. Campos was appointed Senior Economic Advisor by the Consulate General of Brazil in New York, during which time he worked in liaison with foremost economic policy institutions in the United States. Following, he served as a consular official and Director of the Cultural Council of the Brazilian Endowment for the Arts. Dr. Campos’ previous positions include Cultural Attaché to the Brazilian Embassy in Tunis, Tunisia and Delegate Ad Hoc of Brazil to the 7th World Congress of Public Relations in Boston, MA. Fluent in many languages, Dr. Campos was appointed Examiner of Arabic, German, and Russian during the selection of foreign service officers at Instituto Rio Branco in Brazil. He also served as Professor & Consultant of Tourism Administration at the Pontifícia Universidade Católica do Rio de Janeiro and Universidade de Brasília. Dr. Campos graduated in Decision Science from Wharton School at The University of Pennsylvania, in Hotel Management from Cornell University, and in Human Relations & Public Speaking from Dale Carnegie Institute of New York. He held a Ph.D. in Economics, a Ph.D. in Philosophy & Social Sciences, and four master’s degrees: MBA / MPS in Tourism, MA in Economics, and MA in Philosophy & Social Sciences. Dr. Campos received many high distinctions from the Brazilian Army, Navy, Air Force, and Ministry of Foreign Affairs – and was the 2014 recipient of the Chamber’s Special Merit Award. While conducting postdoctoral research in economics, he participated in countless forums and international conferences on economics, tourism, technology, and sustainability. Dr. Campos is survived by his wife, Marion Asch Campos. His steadfast commitment and contributions to the Chamber strengthened ties between Brazil and the United States and furthered our mission of promoting trade and investment between the two nations. His presence, company, and sense of humor will be greatly missed. |

|

|

|

In 2024, Itaú, Banco do Brasil (BB), and Bradesco are ranked within the world’s 500 most valuable brands.

This report comes from Brand Finance and was presented at the World Economic Forum in Davos, Switzerland, on January 17.

Banco do Brasil stands out, jumping 50 places since 2023. This leap marks it as the fastest-growing Brazilian brand in value.

By Richard Mann via The Rio Times

The Brazilian-American Chamber of Commerce is pleased to announce Paula Vieira de Oliveira as Co-Chairperson of the Legal Programs & Events Committee, serving alongside Co-Chairperson Maurizio Levi-Minzi. Ms. Vieira is Partner in charge of Mattos Filho’s New York office and a member of the firm’s corporate / M&A practices. She is skilled in Brazilian and cross-border M&A transactions, private equity, inbound investments, and commercial contracts involving public and private companies in many industries and sectors. She also advises management bodies and shareholders on corporate regulatory matters. Ms. Vieira is a graduate of Pontifícia Universidade Católica de São Paulo (PUC-SP) and holds a Master of Laws from the University of Pennsylvania.

At the 2024 Annual Membership Luncheon, to take place in February / March, all new committee chairpersons will be officially announced. We are privileged to have Ms. Vieira assist in the development of Chamber programs and seminars focusing on key legal issues in Brazil-US business.

As of April 10th, 2024 , passport holders from Australia, Canada and the United States will require an e Visa to enter Brazil. If you have a valid physical visa on your passport for the purpose of your visit, you do not need to apply for a new visa. For special passports you still need an e Visa or physical visa if you are traveling with a diplomatic passport.

Via United Airlines

After falling last year, the number of M&A operations in Brazil is expected to recover in 2024.

Consulting firm Kroll registered 1,400 transactions last year, compared to 1,543 in 2022.

“In 2024, we’ll see the return of a record volume of M&A operations, to around 1,600, as we had in 2021. This is because I expect the return of appetite from foreign investors amid a reduction in interest rates in Brazil and due to less political noise,” Alexandre Pierantoni, the head of Kroll’s corporate finance and M&A area, told BNamericas.

President Luiz Inácio Lula da Silva returned to the presidency in January 2023, narrowly defeating Jair Bolsonaro in October 2022. The transition of power led market players to postpone investment decisions until the government’s plans became clearer.

In addition, M&As and the capital market were impacted by a high base rate of 13.75%. The central bank started a reduction cycle only in August as inflation fell, with the benchmark Selic currently at 11.75% and further reductions expected.

“The positive impacts of the Selic reduction will still materialize, especially when we reach a single-digit level, closer to 9%. I believe that from the second half of the year we will see signs of the return of IPOs, which will also help to provide traction to M&A movements,” said Pierantoni.

The financial and technology sectors will remain the most significant ones in terms of transactions, followed by energy and water.

“São Paulo state is expected to complete the privatization of water utility Sabesp this year, which in itself is a major operation. Furthermore, the completion of this operation could attract even more investor interest to companies in the sector, including to companies that are not yet listed,” added Pierantoni.

Recently, Sabesp hired banks to handle part of the privatization, which is envisaged as a share offering planned for this half. The state owns 50.3% and wants to keep 15-30%. The rest of the shares are listed in Brazil and the US.

Sabesp is one of the world’s biggest firms in the sector, providing potable water to 28.7mn people and sewage services to 25.5mn.

Via BNamericas.

NEWSLETTERS 20 . Dezembro . 2023

O impacto da presença de influenciadores digitais no mercado financeiro, que será analisado pela CVM por meio de consulta pública, é um dos destaques desta edição, na seção Companhias Abertas. As novidades em Ofertas Públicas e Fundos de Investimento incluem o início do processo de consulta para revisão das normas aplicáveis a ofertas públicas de aquisição; e a divulgação das orientações sobre o preenchimento de informação de cotistas no Banco Central.

FUNDOS DE INVESTIMENTO

Governance | 5 Key Agenda for Medium and Large Brazilian Companies in 2024

Brazilian companies that we have seen grow, innovate and generate value in different segments of Brazilian economy have in common strategic attention to medium and long-term funding, governance, talent attraction and M&A opportunities.

The factor below apply to companies in all major sectors in Brazil, including agribusiness, technology, manufacturing, finance, energy, and others.

Companies that want to grow in 2024 should consider the following 5 themes in their strategic plans:

Even so, agribusiness companies issued more than BRL100 billion in Agribusiness Receivables Certificates (CRA) so far in 2023, acquired by funds, family offices and other investors, to raise medium to long-term resources (5 to 10 years).

Likewise, companies in the real estate sector issued Certificates of Real Estate Receivables (CRI) in high volumes to finance projects and costs of projects already built, with terms of 5 to 10 years.

Commercial Notes and Debentures are also medium and long-term funding options for companies.

Even so, agricultural, industrial and technology companies export commodities, value-added products and services that generate receivables in dollars and other hard currencies that can be financed by foreign funding.

There are several foreign financial institutions, trading companies, funds, family offices and investors that finance exports of Brazilian companies, via export prepayment lines, direct loans, draft (international duplicate discount), among others, in a volume that exceeds US$50 billion annually.

Companies should seek these financing channels as another funding alternative, especially in hard currency.

Not long ago, I participated in a PwC climate-action roundtable in Mumbai. One of the attendees, an executive from a hospital group, made an observation that grabbed my attention: the seasonal changes being caused by global warming, he said, were affecting the patterns and frequency of vector-borne diseases. His hospitals were increasingly having capacity issues, with sick patients coming in earlier and later in the year than before, straining hospital resources, from beds to diagnostic facilities.

By Ashok Varma via PwC

Realizada entre os dias 30 de novembro e 12 de dezembro deste ano, a 28ª edição da Conferência das Partes (COP-28) tem como principal objetivo avaliar e trazer insights quanto ao progresso dos países signatários no que diz respeito ao atingimento das metas do Acordo de Paris.

Neste contexto, alguns dos nossos líderes globais vão marcar presença para discutir meios de alavancar ações significativas para frear a crise climática que estamos enfrentando, discutindo temas como: financiamento e expansão da tecnologia climática, transformação da demanda de energia, adaptação climática para proteger a cadeia de valor e a sociedade, estratégias empresariais positivas para a natureza.

O nosso sócio e líder de Environmental, Social e Governance (ESG), Mauricio Colombari, representará a PwC Brasil na COP 28. Além da presença da nossa liderança, a PwC, por meio do seu Plano Net Zero 2030, está compondo o portfólio de projetos apresentados no evento pela iniciativa Brasil pelo Meio Ambiente, da Amcham e ICC Brasil.

Para acompanhar as discussões da COP 28, fique de olho nas coberturas jornalísticas do evento e siga a página da PwC Climate.

Via PwC Brasil

Tarciana Medeiros, the first female President of Banco do Brasil, extends an invitation to all as a woman, mother, and global citizen. Join her in watching this video, part of a worldwide campaign by Banco do Brasil, the world’s most sustainable bank. This initiative champions the cause of the Amazon and the sustainability of human rights. These are programs and proposals that envision the future as an investment. The forest calls out, nature beckons us toward balance, profit, life, results, and the future. Brazil is ushering in a new era – the era of sustainable progress.

Via Banco do Brasil

Paula Vieira’s strong international experience is set to strengthen the firm’s strategy and relationships with foreign clients seeking to do business in Brazil

Mattos Filho has announced Paula Vieira as the new partner in charge of the firm’s New York office. With a strong background in both Brazilian and cross-border M&A transactions, including private equity, Paula is a member of Mattos Filho’s Corporate/M&A practice and International Committee, where she coordinates the firm’s initiatives for business development outside Brazil.

Mattos Filho’s presence in New York has spanned over a decade, helping bridge the gap between international clients and their interests in the Brazilian market. It has allowed for broader perspectives and ample opportunities to collaborate with companies, investors, and business partners looking to expand their interests in Brazil, as well as to connect Brazilian clients with the right business partners in connection with their outbound investments.

“We are excited about moving into this new phase of our international business strategy, and we wish Paula the utmost success in her new role,” commented Mattos Filho’s managing partner, Roberto Quiroga.

“The opportunity to lead the New York office and work closely with our clients and business partners in the United States will enable Mattos Filho to strengthen and develop further its international relationships and presence. I am deeply honored to represent Mattos Filho in a broader capacity.”

Paula Vieira

Part of Mattos Filho for 25 years, Paula Vieira has been a partner in the firm’s Corporate/M&A practice since 2010. Beyond her experience in M&A matters (including private equity), Paula is involved in foreign investments in Brazil and public and private commercial contracts across many sectors and industries.

Paula’s strong background in international matters and business development includes her active role on committees at the International Bar Association (IBA), where she is engaged in the Latin American forum as well as in other committees such as the M&A committee. Paula previously also worked as an international associate at the New York office of Simpson Thacher & Bartlett LLP.

With a Master of Laws (LL.M.) from the University of Pennsylvania, Paula has a Bachelor of Laws and a Specialization in Business Law from Pontifícia Universidade Católica de São Paulo (PUC-SP), as well as a Specialization in Finance and Accounting from Fundação Getulio Vargas (FGV).

Via Mattos Filho

DLA Piper is pleased to welcome Amadeu Ribeiro as a partner in the firm’s cross-border Antitrust and Competition practice, expanding the firm’s already strong presence in New York and Latin America.

Ribeiro advises international clients on complex antitrust matters, including merger review cases, cartel and market dominance investigations and competition related matters in general. He counsels clients across a wide breadth of sectors, including aviation, automotive, food and beverage, pharmaceutical, natural resources and technology.

“DLA Piper is committed to providing the highest quality client support throughout the Americas, offering counsel to domestic and multinational companies with interests and operations throughout the region,” said Richard Chesley, managing partner of the Americas and co-US managing partner. “Amadeu is recognized as a leader in the antitrust space and expands the capabilities of an already robust cross-border team.”

“We are thrilled to welcome Amadeu as an integral part of our global practice of lawyers focused primarily on Latin America,” said Francisco Cerezo, chair of the US-Latin America practice.

DLA Piper in Latin America’s team offers full-service business legal counsel to US and global companies with interests in and operations throughout the region. With over 450 lawyers practicing throughout Argentina, Brazil, Chile, Colombia, Mexico, Peru, and Puerto Rico, in addition to our US-based cross-border attorneys, our team works with clients throughout every country in Latin America and help connect Latin America to the world.

The Latin America Practice is led in the US from Miami, with our US based team of multicultural and diverse cross-border practitioners regularly acting as lead counsel on a wide range of matters across sectors in the US and Latin America. These range from complex TAX, IP, capital markets, finance, M&A and public private partnerships to regulatory, compliance, disputes, market entry and establishment issues. The United States, specifically New York and Florida, has deep economic and cultural ties to Latin America. For more information, visit Latin America | DLA Piper.

Via DLA Piper

A United Airlines, uma das maiores companhias aéreas do mundo, que opera voos entre o Brasil e os Estados Unidos, e líder em investimentos para a produção de combustível de aviação sustentável, foi uma das patrocinadoras de dois eventos brasileiros voltados à sustentabilidade: Brazil Climate Summit, que aconteceu nos dias 13 e 14 de setembro, e SDGs in Brazil, promovido pela rede brasileira do Pacto Global da ONU nos dias 14 e 15 de setembro, ambos em Nova York.

Para Jacqueline Conrado, Country Manager da United Airlines no Brasil, o país é muito importante por ser um celeiro de iniciativas sustentáveis e comprometidas com o meio ambiente. Além disso, o setor de aviação tem que apresentar soluções de viagem mais flexíveis e responsivas à experiência do usuário, revolucionando inclusive a forma de fazer negócio. “Hoje, nós fazemos um trabalho muito mais focado em ouvir e perceber os inputs dos clientes como nunca, que não aparecem relacionados só a preço, mas a experiência de viagem, benefícios e, de forma prioritária, à preocupação com o meio ambiente e diversidade e inclusão”, diz.

Por Luiz Fara Monteiro via R7

The Icla da Silva Foundation Hope Gala

The Icla da Silva Foundation Hope GalaJoin our friends from the Icla da Silva Foundation at their 2023 Hope Gala. Enjoy an auction, dinner, and dancing at the prestigious University Club of New York on October 2, 2023 at 6:30 pm.

You will network with leaders of industry while raising funds that remove financial barriers for patients whose only cure is a bone marrow transplant.

As mineradoras precisam lidar com um importante novo player que surgiu no mercado de minerais críticos: o governo. Diante do rápido crescimento da demanda e da concentração da cadeia de suprimentos em níveis preocupantes, os governos formaram alianças, instituíram novas políticas e mobilizaram fundos para garantir o acesso a minerais críticos. Esses movimentos mudarão o negócio de mineração. A entrada de fundos públicos, por exemplo, deve levar as mineradoras a repensar as taxas de retorno que podem esperar da mineração ou dos ativos da cadeia de suprimentos. As mineradoras também precisarão lidar com um risco maior de investir e o aumento da concorrência, uma vez que os governos interferem no cenário com incentivos e intervenções.

Via PwC Brasil

The Chamber is delighted to welcome Corporate member Peter Fernandes & Marihá Viana Advogados Associados to the Legal Programs & Events Committee.

A highly regarded law firm located in Brazil’s capital city, Brasília, Peter Fernandes & Marihá Viana Advogados Associados leverages innovation to achieve successful solutions through legal services, offering expertise in a wide range of practice areas.

Wed, Aug 23, 2023 9:00 AM BRT

Programação:

Via PwC.

The Brazil Data Protection Agency (“ANPD”) on August 15, 2023 released a draft of the International Transfer of Personal Data Regulation (“Regulation Draft”) and the standard contractual clauses (“SCCs”) for public comment. Interested parties can submit comments to the provisions of the Regulation between August 15 and September 14, 2023. After the comments period is closed, the ANPD will hold a public hearing to discuss the draft at a date to be determined. Once the Regulation Draft is approved, it will take effect immediately upon publication and companies will have 180 days to incorporate in their existing SCCs agreements the ANPD’s version or implement new agreements with the ANPD SCCs.

By way of background, the ANPD is the agency charged with implementing Brazil’s General Data Protection Law (“LGPD”). The LGPD is Brazil’s all-encompassing data protection law similar to the European Union’s GDPR. The LGPD imposes certain requirements on data processing agents (which include controllers and processors of data) to safeguard the data privacy rights of individuals (data subjects).

The newly issued Regulation Draft provides that the ANPD will determine which jurisdictions have an adequate level of data protection that will allow the free flow of personal data between Brazil and such countries, but the ANPD will prioritize the review of jurisdictions that provide reciprocal protections. It may take some time before we have a list of countries with data protection levels the ANPD deems adequate. In the interim, multinational countries will have to rely on other possible mechanisms to transfer personal data from Brazil.

According to the Regulation Draft, the ANPD may recognize as an equivalent the SCCs of other countries, upon their review and approval. The review procedure may be started by the ANPD or an interested party, but the ANPD will prioritize the review of those SCCs that can be widely used by processing agents performing international transfers of data in similar circumstances. Foreign SCCs recognized by the ANPD as equivalent will be considered a valid alternative.

The Regulation Draft also provides for the approval process of specific contractual clauses and global corporate rules, but it does not include the expected timeline for the review and approval of such.

A more readily available mechanism will be the ANPD SCCs, and the Regulation Draft includes a SCC Draft template, which companies may eventually choose to use, although there will be some challenges if the SCC Draft remains as-is after the public consultation.

The ANPD opted to create only one module of SCCs and it is in many aspects different from the EU SCCs. One provision that immediately catches one’s attention is that regardless of whether the exporter or importer is named as the responsible party for certain measures (as the Designated Party), the controller will ultimately remain responsible for (i) compliance with the obligations under the law and the agreement, (ii) responding to the ANPD, (iii) guaranteeing the data subject’s rights and (iv) the reparation of damage they may suffer. Moreover, when exporter and importer are processors, the controller, which instructs the processor that exports the personal data to the importer outside Brazil (the “Third-Party Controller”), must co-sign the SCCs and be ultimately responsible for the obligations mentioned above.

By Renata Neeser via Littler.

Amazon.com (AMZN.O) will launch a credit card offering in Brazil, in a partnership with Brazilian lender Banco Bradesco SA (BBDC4.SA), the bank’s chief executive said on Friday, as the ecommerce giant pushes to expand its fintech offering.

The launch is set for next Tuesday, according to CEO Octavio de Lazari Junior, adding that the bank will manage the card’s credit risk, and the card will be powered by Mastercard (MA.N).

Reporting by Alberto Alerigi Jr., Additional reporting by Isabel Woodford, Writing by Carolina Pulice, Editing by Sandra Maler via Reuters.

Latham advised Natixis and BNP Paribas, as coordinating lead arrangers and lenders, and BNP Paribas, as administrative agent and intercreditor agent, on the transaction, which was structured as a 3-year revolving credit facility. The facility was sized in contemplation of a +400 MW PMGD platform, and was initially used to refinance two previously acquired portfolios of operational assets aggregating 101 MW. The facility is expected to be used to acquire, develop, construct, and refinance other portfolios of both operational and construction projects sponsored by BlackRock.

Via Latham & Watkins

More forward-thinking organizations are taking advantage of innovative technology as transparency requirements continue to grow.

In Part 2 of our “Reimagine Risk and Unlock Opportunities” series, Tiffany Gallagher, Health Industries Risk and Regulatory Leader, PwC US, and Tim Canonico, Principal, Pharmaceutical and Life Sciences, PwC US, analyze the growth of transparency programs and the opportunities that organizations can focus on to succeed.

The goal of global transparency requirements is to encourage the right interactions with Healthcare Professionals and help Pharmaceutical and Life Sciences companies build more trust and transparency in healthcare for society. This landscape is continuing to rapidly evolve as voluntary requirements are being codified into law and other requirements expand to demand more transparency from more organizations.

Via PwC

Since the inception of the Form I-9 in 1986, the process of employment eligibility verification had relied on in-person physical documentation examination. The COVID-19 pandemic brought a temporary option, however, which permitted virtual, remote verification for remote employees. The USCIS previously announced that this option was ending on July 31, 2023. Thus, this new alternative procedure begins the next day, August 1.

This alternative virtual verification procedure is available only to qualified employers. Such employers are:

To utilize the alternative virtual verification, qualified employers must:

Qualified employers have the choice to use the alternative permanent virtual verification procedure or not. Additionally, qualified employers may opt to use this procedure for remote employees only, and not for employees who work onsite or in hybrid capacity. Employers may not discriminate in this decision-making process.

Quase uma década se passou desde que a PwC identificou cinco megatendências, que caracterizamos como profundas e impactantes, de alcance global e efeito de longo prazo. Megatendências capazes de afetar a todos no planeta e reconfigurar nosso mundo por muitos anos. Agora está claro que as megatendências transformaram nosso mundo ainda mais rápido do que prevíamos. Em grande parte, isso se deve à interação entre elas, que turbinou tanto a velocidade quanto a disseminação da mudança.

À medida que foram se desdobrando, as megatendências também evoluíram. O modo como se manifestam hoje mudou em comparação com dez anos atrás.

Reavaliamos as megatendências para entender como elas mudaram, que futuro podem criar em 2030 e quais questões elas apresentarão à humanidade.

Via PwC

The firm has been voted No.1 for the fifth year in a row in Institutional Investor’s annual All-Brazil Sales Team. Based on the votes of 367 buy-side money managers at 239 firms with significant holdings in the country, BTG Pactual extended its reign to half a decade — even as the ranking saw a shakeup further down the leaderboard among domestic and global firms alike.

Itau BBA rose from last year’s fourth place to take second, while last year’s runner-up, Bradesco BBI, dropped one spot to third. Credit Suisse improved one spot to take fourth, while JPMorgan Chase — in a steep rise from 2022’s ninth place — rounded out the top five. In line with other II surveys, votes were weighted based on respondents’ commission spending in the region. An additional AUM-weighted leaderboard was also produced which mirrored the commission-based results.

The volatility in this year’s results was reflective of the tumultuous year investors experienced in Brazil, due to an election cycle in late 2022 and depressed market activity.

“Clients were a bit lost at the start of the year, given the change of government and the outlook ahead. People lost a lot of money betting on a more centric-approach government, and the reality was a bit different,” said Thiago Faganello, head of Brazil sales and partner at BTG Pactual. “But things changed recently and quickly, so tons of opportunities showed up and clients are now trying to stock pick the best names for this new cycle.”

By Alexandra DeLuca via Institutional Investor

UBS Group AG named Sylvia Coutinho Brazil country head and the regional leader for Latin America businesses as the Swiss bank integrates teams from its acquisition of Credit Suisse Group AG.

Marcello Chilov, Credit Suisse’s former chief executive officer in Brazil and head of wealth management for Latin America, will run UBS global wealth management in Latin America, according to an internal memo seen by Bloomberg News. The changes take effect July 17.

Coutinho has been at UBS for more than 10 years, and was UBS’s Brazil country head prior to the merger. She was also head of wealth management for Latin America. In her new role, she will focus on leading integration efforts as well as overseeing regulatory, governance and collaboration between businesses for the region. She will report to Naureen Hassan, president of UBS Americas.

By Cristiane Lucchesi via Yahoo!Finance

On July 6, 2023, the first sanction imposed by the Brazilian Data Protection Agency (“ANPD”) against a company (controller) in Brazil was published in the official gazette. The ANPD is the agency charged with enforcing Brazil’s General Data Protection Law (“LGPD”).

The publication does not provide the details about the results of the investigation conducted by the ANPD against a company, but the sanctions provide a glimpse of the underlying circumstances.

The sanctions included:

By Renata Neeser via Littler

Se você tem de 18 a 26 anos e quer maximizar o seu potencial, desenvolvendo habilidades e competências que fazem a diferença hoje e que serão cada vez mais necessárias no futuro, faça parte do nosso Programa Access Your Potential.

O Access Your Potential (AYP), da PwC Brasil, visa maximizar o potencial de jovens em contextos adversos, criando possibilidades de carreira e inclusão produtiva. O objetivo principal é proporcionar o desenvolvimento de competências que fazem a diferença hoje e que serão cada vez mais necessárias no futuro. Para isso, oferecemos cursos de alta qualidade, mentoring para o desenvolvimento de projeto de vida e acesso a oportunidades de carreira. A cada ciclo do programa, conectamos jovens de todo o país com profissionais voluntários da firma.

Via PwC

Se interessou?

A nova temporada de balanços corporativos referentes ao segundo trimestre não deve impulsionar ganhos adicionais no mercado acionário dos Estados Unidos. A avaliação de Michael Wilson, estrategista-chefe para ações e CIO (executivo-chefe de investimentos) do Morgan Stanley (MS) e considerado uma das vozes mais pessimistas de Wall Street, ampliando o consenso em torno dessa percepção já evocada por outros de seus pares.

Segundo o estrategista, desta vez os guidances (projeções) a serem anunciados pelas empresas serão mais importantes do que o normal para o movimento das bolsas, tendo em vista os elevados valuations das ações, as taxas de juros mais altas da liquidez cada vez menor.

“Com o início da temporada de balanços corporativos do segundo trimestre nesta semana, resultados melhores do que o previsto provavelmente não serão mais ‘suficientes’ para disparar novos ganhos em Wall Street”, escreveu em relatório nesta segunda-feira (10).

By Sagarika Jaisinghani via Bloomberg Línea

09:00 – 09:20 Abertura/Pesquisa Incial

09:20 – 10:00 Palestrante: Melissa Schleich

10:00 –

10:20 Palestrante: Mauricio Colombari

10:20 – 10:40 Palestrante: José Vital

10:40 – 11:00 Perguntas e Respostas (Q&A)

11:00 – 11:15 Prova de conhecimento/Encerramento

15h — Abertura “Por dentro da Gestão Tripartite”

(AgTech Garage, Ubyfol e Prefeitura de Uberaba)

15h30 — Bem-vindos ao Moon Hub by AgTech Garage

16h10 — Painel “Conhecendo a Comunidade Uberabense”

(Agentes locais e clientes convidados)

17h10 — Tour pelo Moon Hub e Happy Hour

Setor de Tecnologia lidera volume de operações com 17,5% das transações, seguido de Instituições e Serviços Financeiros com 14,8%. Setor de Saúde representou 6,1%, seguido pelos Setores de Produtos de Consumo, Energia e Logística, que representaram, cada um, 4,5% das transações anunciadas. Agronegócios vem aumentando sua relevância, passando de históricos 1,5% para 3,8% das operações anunciadas. Setor de Varejo, enfrentando desafios e que já se destacou em relevância de operações, representou 4,8% das operações.

By

Alexandre Pierantoni

Managing Director

Head of Brazil Corporate Finance

São Paulo

+55 11 3192 8103

+55 11 9 5500 8151

alexandre.pierantoni@kroll.com

And

José Thompson

Director

Corporate Finance

São Paulo

+55 11 3192 8108

jose.thompson@kroll.com

Via Kroll

A PwC está colaborando com o Fórum Econômico Mundial para ajudar a impulsionar a transição para mercados de trabalho que priorizem as habilidades.

Esse movimento poderia abrir o mercado de trabalho para 100 milhões de pessoas em todo o mundo, trazendo benefícios não apenas para empresas e indivíduos, mas também para a sociedade em geral e para a economia.

Nosso relatório conjunto, “Habilidades em primeiro lugar: um framework para ação”, apresenta um framework consistente sobre o assunto para CEOs e governos e demonstra como algumas organizações já estão se beneficiando de uma cultura que prioriza as habilidades.

Via PwC

The initiative is part of the expansion plan to expand the existing relationship for over 15 years with the US and the international market, in addition to continuing to provide legal advice to foreigners who want to invest in Brazil, and also Brazilians who want to expand their businesses internationally.

“This expansion reinforces one of our most important ‘non-negotiable principles’, which is to be present in the key international financial and business centers that have relationship with Brazil. With the New York office, we want to be physically closer to our clients, banks, funds, investors and partners, foreign and Brazilian, and global companies that use New York – the main world financial center – as a hub for business”, highlights the managing partner of Feijó Lopes Advogados, Lúcio Feijó Lopes.

“Generating results for our clients is what drives us, whether it be legal assistance in strategic commercial negotiation, venture capital, M&A, fund structuring, debt offerings, tax and labor issues, or conflict resolution. We are faithful to our purpose of being the law firm of choice for our clients to solve their greatest challenges”, concludes Lopes.

The new office should be located at Park Avenue, midtown, New York, an area where the main banks, fund managers and headquarters of global companies and with business in Brazil are located.

Imagine um futuro em que os médicos conduzam ensaios clínicos com pacientes remotos, o atendimento digital seja feito tão facilmente como nas compras on-line e os médicos usem a inteligência artificial para prestar serviços hiperpersonalizados.

De acordo com o nosso estudo Futuro da Saúde, até o fim da década atual, a saúde será ainda mais personalizada, digitizada e apoiada por inteligência artificial, com soluções perfeitamente integradas à vida diária dos pacientes. A questão crítica é: os sistemas de saúde estão fazendo o suficiente para adaptar e transformar sua infraestrutura atual ou correm o risco de se tornarem totalmente obsoletos?

Via PwC

We are very pleased to reveal our firm’s outstanding performance in the Chambers Brazil rankings, one of the leading guides in the legal sector.

In the Industries & Sectors chapter, we led in the number of recognized practices (16) and professionals (34). In the Regions chapter, five practices and 13 professionals were recognized across our offices in Campinas, Brasília, and Rio de Janeiro.

We would like to thank Chambers for these recognitions, which serve to reinforce our commitment to excellence and our role as a strategic partner for your business.

Our member Pellecchia International invites you to an event on June 28th hosted by Columbus Citizens Foundation.

Wednesday, June 28th

6:00PM Reception | 6:30PM Talk

CCF | 8 East 69th Street, New York, NY 10021 | $35

Daniel Runde, Senior Vice President and Director of the Project on Prosperity and Development (PPD), discusses strategic international affairs. Runde shares insights from his Amazon #1 New Release, “The American Imperative – Reclaiming Global Leadership Through Soft Power,” and the path towards building strong alliances of like-minded nations, focusing on non-military strategies to prevent the rise of authoritarian powers.

Our Member, REDD, is proud to announce the release of The REDD Eye – their newest podcast news briefing, released every Monday morning.

The REDD Eye is a 3 min financial news podcast, which summarizes the week’s most important high-yield credit headlines in Latin America, hand-picked by their editors.

Available in English, Spanish, and Portuguese. On Spotify, RSS and Apple Podcasts.

Don’t forget to follow them!

Analistas do JPMorgan elevaram a recomendação para as ações da Petrobras (PETR4;PETR3) de “neutra” para “overweight”, citando redução na percepção de risco, bem como dividendos alinhados a pares globais, de acordo com relatório enviado a clientes nesta segunda-feira (12).

Eles também elevaram os preços-alvo dos papéis PN (preferenciais) e ON (ordinários), negociados na B3, de R$ 30,50 para R$ 41; e dos ADRs, recibo de ações negociados nos Estados Unidos, de US$ 11,50 para US$ 15,50.

Na última sexta-feira (9), as preferenciais da Petrobras fecharam a 30,28 reais e as ordinárias, a 33,75 reais. Nos EUA, o ADR das ONs encerrou a 13,76 dólares e o das PNs a 12,44 dólares.

By Reuters via Forbes Brasil

Generative AI, which is a type of artificial intelligence that can produce or create new content, has already started to impact the workplace in various ways. On the positive side, it can automate repetitive and time-consuming tasks, leading to increased efficiency and productivity. For example, it can assist with data entry, customer service, and content creation. Additionally, it can help businesses to analyze and make sense of large amounts of data, leading to better decision-making.

However, the rise of generative AI also raises concerns about its impact on labor and employment. It is predicted that many jobs that involve routine tasks, such as data entry, customer service, and content creation, could be replaced by AI systems in the future. This means that some workers may need to reskill and transition into new roles to stay relevant in the job market.

By Zoe Argento, ChatGPT, Michael Chichester, Michelle Clark, Tessa Gelbman, Philip L. Gordon, Corinn Jackson, Allan King, Miguel Lopez, Deborah Margolis, Melissa McDonagh, Michael McGuire, Ellie McPike, Marko Mrkonich, Jim Paretti, Niloy Ray, Scott Rechtschaffen, Erin Reid-Eriksen, Kellen Shearin, and Alice Wang via Littler

Banco com cerca de R$ 100 bilhões aplicados no agro entra em mais uma modalidade de comércio de produtos, um mercado estimado em R$ 185,7 bilhões para 2023

O Bradesco anunciou nesta segunda-feira (5) o lançamento do E-agro, marketplace para operar no setor do agronegócio. A plataforma é destinada à oferta de produtos e serviços financeiros e não financeiros para o produtor rural, clientes e não clientes da instituição financeira.

“O lançamento do E-agro é muito representativo. Crescemos concedendo crédito aos agricultores e temos hoje um universo potencial de mais de dois milhões de produtores rurais no Bradesco, que integram a cadeia do setor brasileiro que mais cresce”, afirma José Ramos Rocha Neto, vice-presidente do Bradesco. Com cerca de R$ 100 bilhões aplicados no setor, o Bradesco é o maior banco privado na concessão de crédito ao agronegócio. Em 2022, o Bradesco teve lucro líquido contábil de R$ 20,73 bilhões e conta com uma base da ordem de 77,1 milhões de clientes.

By Redação via Forbes

Brazil’s largest private lender Itau Unibanco is in talks with Banco Macro SA to sell its operations in Argentina, the lender said on Tuesday, a move that comes as the neighboring country grapples with a severe economic crisis.

Itau disclosed the “preliminary talks” in a securities filing, touting Macro as “one of the main private banks in Argentina with an extensive network of branches,” but noted that no binding agreement had been reached so far.

Itau’s operations in Argentina are moderately sized in terms of personnel and branches, but its loan portfolio in the country is relatively small when compared with other markets such as Chile and Colombia.

By ia Reuters

Signs of de-dollarisation are unfolding in the global economy, strategists at the biggest U.S. bank JPMorgan said on Monday, although the currency should maintain its long-held dominance for the foreseeable future.

The strains of steep U.S. interest rate rises and sanctions that have frozen Russia out of the global banking system have seen a fresh push by the “BRICS” nations, Brazil, Russia, India, China and South Africa, to challenge the dollar’s hegemony.

JPMorgan strategists Meera Chandan and Octavia Popescu said that while overall dollar usage is within its historical range and the greenback remains at the top of the pack, a closer look shows a more bifurcated picture.

By Marc Jones via Reuters

U.S. immigration policy and the Biden administration’s response to the ongoing migration crisis have been hot topics in the news. We break down potential considerations for employers as the pandemic-era immigration policy ends and border crossings from individuals without documentation in search of asylum are expected to rise sharply.