Meet our New Member Barbosa, Müssnich e Aragão – Advogados

Their commitment to their clients and their availability, agility and desire to innovate has made them what they are today: a full service law firm with a highly-motivated, integrated and specialized team. Their partners and associates have a profound knowledge of public and private sectors, both regulated and unregulated, and are tireless in the search for creative, bold, sophisticated and advantageous outcomes for their clients.

Following a year of medical, social and economic upheavals, with nearly every organization rethinking how it does business and some experiencing major cyber intrusions amid the pandemic, where are customers when it comes to trusting companies with their data? Will they continue purchasing products and services from companies with which they’ve done business for years, even those affected by significant breaches?

Consumers once remained loyal to businesses despite mistrust over how their data was used. Most kept coming back even after well-publicized security breaches.

This phenomenon, the gap between the value consumers say they place on privacy and how they actually behave, has been called the privacy paradox by some experts on consumer behavior. Some who claim to be disturbed by privacy threats will keep giving away their personal data on social media platforms and elsewhere online, even returning to companies hit by theft of customers’ data.

Via PwC.

Justos, a startup that says it will be the first insurance company in Brazil to use data when determining rates, has raised a $35.8 million Series A round of funding led by Ribbit Capital.

SoftBank’s Latin American Fund and GGV participated as new investors, in addition to existing backers Kaszek, BigBets, Nubank CEO David Velez and Kavak CEO Carlos Garcia Ottati.

In May, Justos had announced a $2.8 million seed raise that included participation from Kaszek, one of the largest and most active VC firms in Latin America, and the CEOs of several unicorns including Assaf Wand, CEO and co-founder of Hippo Insurance; Sergio Furio, founder and CEO of Creditas; Patrick Sigrist, founder of iFood and Fritz Lanman, CEO of ClassPass. Senior executives from Robinhood, Stripe, Wise, Carta and Capital One had also put money in the round.

By Mary Ann Azevedo via TechCrunch.

World leaders face six interconnected challenges, and although approaches and solutions will differ by country, taking key actions will benefit all.

The year 2020 was full of challenges for world leaders. No country was spared from the COVID-19 pandemic or the related economic, educational and national security crises. Issues of climate change became even more acute than they already were, with a record number of natural disasters, including fires, hurricanes and droughts. And geopolitical instability became a shared experience within and across nations, affecting countries that have been fragile for a long time and those that were previously viewed as stalwarts of democracy and stability. These challenges persist in 2021.

Citizens and businesses are looking to their government leaders to help them navigate and emerge stronger from these large-scale, complex problems. Most stakeholders have accepted that going back to the way things were in 2019 is not an option—or even a goal. Thinking ahead to 2022, they want a better future, informed by the lessons of 2020 and now 2021.

Via PwC

O consumo é um dos pilares da vida atual e uma das atividades que impactam diretamente a exploração de recursos naturais, nota-se uma tendência de mudança na forma de consumir. Além disso, percebe-se uma grande movimentação nos diversos segmentos do mercado para contribuir para a mudança do mindset do consumidor para um consumo consciente. Por isso, nosso evento tem como objetivo discutir medidas sustentáveis e impulsionadoras do consumo consciente dos segmentos de Produto, Aplicativo/tecnologia e serviços.”

Abertura:

Eduardo de Campos Ferreira – sócio da área Ambiental do Machado Meyer

Debatedores:

Rodolfo Araújo – Head de Legal e Tax do Ifood

Ana Paula Jacobus Pezzi – Gerente Jurídica da JBS

Eliane Santos – Gerente de Sustentabilidade Mercado Brasil na Natura

Mediação:

Thais Matallo Cordeiro – sócia da área Contenciosa, especialista em assuntos estratégicos de relações de consumo do Machado Meyer.

Oct 27, 2021 09:00 AM in Sao Paulo

Google made waves in Manhattan real estate when it bought the iconic Chelsea Market and its 2.9 million-square-foot New York headquarters building within a few years of each other in the past decade. The technology giant followed up last month with the largest U.S. real estate transaction since the pandemic, a $2.1-billion purchase of the under-construction St. John’s Terminal.

Google’s takeover of Manhattan’s West Side has been mirrored to varying degrees by Amazon, Microsoft, Apple, Facebook and Salesforce, each of which has established a campus in the city. The surge in real estate occupancy shows how technology companies are rapidly displacing counterparts in banking and finance as the city’s biggest industry in the aftermath of the pandemic: Big tech also leads in employment growth and by volume of companies.

Two decades ago, Tim Armstrong, 50, became Google’s first New York-based employee. “If you were having a cocktail party for all the people who worked in the internet in New York, you could fit them all in a bar,” Armstrong says. “Now I’m guessing you’d have to take over Madison Square Garden, plus the Javits Center to fit everybody in.”

By David Jeans via Forbes.

ATLANTA – The U.S. Small Business Administration (SBA) has put more than $160 million in financial assistance into the hands of residents of New York, New Jersey and Pennsylvania to help them recover from the damages caused by the remnants of Hurricane Ida. As of Oct. 13, the SBA had approved 3,319 loans for a total of $160,671,100. “Hurricane Ida cut a wide swath of damage, and SBA’s mission-driven team is working hard to help affected small businesses and residents with their recoveries,” said Kem Fleming, Director of the SBA’s Field Operations Center East. “We’re committed to providing federal disaster loans swiftly and efficiently, with a customer-centric approach to help businesses and communities recover and rebuild.”

Businesses, homeowners, renters and private nonprofit organizations in 28 primary counties in New York, New Jersey and Pennsylvania are eligible to apply for physical disaster loans from the SBA. Those include the New York counties of Bronx, Kings, Nassau, Queens, Richmond, Rockland, Suffolk and Westchester; the New Jersey counties of Bergen, Essex, Gloucester, Hudson, Hunterdon, Mercer, Middlesex, Morris, Passaic, Somerset, Union and Warren; and the Pennsylvania counties of Bedford, Bucks, Chester, Delaware, Montgomery, Northampton, Philadelphia, and York.

Small businesses and most private nonprofit organizations in counties adjacent to the primary counties are eligible to apply only for SBA Economic Injury Disaster Loans.

To be considered for all forms of disaster assistance, applicants should register online at DisasterAssistance.gov or download the FEMA mobile app. If online or mobile access is unavailable, applicants should call the FEMA toll-free helpline at 800-621-3362. Those who use 711-Relay or Video Relay Services should call 800-621-3362.

Businesses and individuals should then complete and return an SBA disaster loan application by visiting DisasterLoanAssistance.sba.gov. They can also obtain individual assistance at one of the recovery centers established in all three states. Locations and hours can be obtained here:

Businesses and individuals can ask questions, obtain loan applications or other information by calling the SBA’s Customer Service Center at 1-800-659-2955 (1-800-877-8339 for the deaf and hard-of hearing) or emailing DisasterCustomerService@sba.gov.

Loan applications can also be downloaded at sba.gov/disaster.

Completed applications should be mailed to: U.S. Small Business Administration, Processing and Disbursement Center, 14925 Kingsport Road, Fort Worth, TX 76155.

About the U.S. Small Business Administration The U.S. Small Business Administration makes the American dream of business ownership a reality. As the only go-to resource and voice for small businesses backed by the strength of the federal government, the SBA empowers entrepreneurs and small business owners with the resources and support they need to start, grow or expand their businesses, or recover from a declared disaster. It delivers services through an extensive network of SBA field offices and partnerships with public and private organizations.

To learn more, visit www.sba.gov.

We are pleased to announce year two of the MS Experienced Professionals Program, designed to recruit and develop talented Black & Hispanic/Latinx professionals with or without a background in Finance.

Program Overview:

The program begins in February 2022 and will be based in Morgan Stanley’s New York office. Upon joining, participants will complete a formal orientation, and a training and development program (expected to be 6-8 weeks) to set them up for success in their new full-time role. Where required, they will also attend training and study sessions to help them prepare for any licensing and registration exams. To enhance the process, participants will also be provided with a wide range of resources and support, including a dedicated program manager, mentor and buddy, and ongoing product-specific training and career management tools.

Qualifications & Requirements:

We welcome highly motivated candidates with 2-8 years of postgraduate work experience in a professional environment from a diverse range of industries, including but not limited to: Aerospace, Consulting, Energy, Engineering, Finance/Accounting, Government, Law, Life Sciences/Pharma, Insurance, and Information Technology & Military/Defense. In line with our diversity commitments, we strongly encourage applicants who self-identify as Black and/or Hispanic/Latinx to apply.

Referral Process:

We invite you to engage your network and refer interested candidates to apply for the

2022 Morgan Stanley Experienced Professionals Program. You can do this by:

· Forwarding the application link to potential candidates in your network, or

· Sending your referral’s resumes to the 2022_msepp@morganstanley.com

· All candidates will be asked to complete either application below by Monday, November 1st, 2021.

o Fixed Income & Bank Resource Management

We will be hosting webinars for all interested candidates to learn more about Fixed Income & Bank Resource Management and Equity Research at Morgan Stanley, the Experienced Professionals Program and the application processes. Please encourage interested contacts to join the event of interest.

· Fixed Income & Bank Resource Webinar – October 26th

· Equity Research Webinar – October 28th

If you have any further questions or need more information, please contact us.

To review all open permanent positions, please click here.

BNY Mellon has joined a consortium working to introduce blockchain technology into international trade finance and digitize how working capital is provided to both suppliers and buyers across the globe.

Through its participation in the Marco Polo Network, BNY Mellon is now able to more efficiently insert liquidity into the international supply chain, providing supply chain finance solutions including both payables financing and receivables discounting to suppliers shipping goods and services to their buyers around the world.

The Marco Polo Network is a consortium of approximately 45 banks that provides an open software platform for trade, payments and working capital financing to banks, corporates and other market participants. It is a cloud-based blockchain-powered network that allows the seamless, secure and fast exchange of trade data assets in a multi-channel environment.

Utilizing Marco Polo, BNY Mellon will not only provide financing to suppliers, but will also have real-time visibility into trade finance instruments and their status, such as purchase orders and invoices.

By PRNewswire.

Finance | 5 Key Points About FIAGRO – The New Brazilian Agribusiness Fund

| Finance | 5 Key Points About FIAGRO – The New Brazilian Agribusiness Fund

FIAGRO – the new Agribusiness Investment Fund is now actively being used by fund managers to finance the Brazilian agribusiness and acquire rural land, with BR$ 2 billion been raised since August. Created by Federal Law 14.130 and regulated by the Brazilian CVM Resolution 93, there are already 17 FIAGROs-Real Estate launched to invest mostly in CRAs (ag receivables securities), but also in rural land, and 3 FIAGRO-Receivables to finance CPRs (rural product note). Due to the success of such new fund’s category, we list below 5 key points about FIAGRO tha may be of investors and fund managers interest: 1. What is FIAGRO: it is an investment fund regulated by CVM dedicated to grant credit, acquire rural land, M&A, asset and wealth planning, among others, in agribusiness. 2. What are the 3 categories of FIAGROs and their target assets: CVM has experimentally authorized 3 categories of FIAGROs: (i) “FIAGRO-Receivables” take the form of “FIDC” and may invest in agribusiness receivables and securities backed by agribusiness receivables, including CRAs and CPRs; (ii) “FIAGRO-Real Estate” takes the form of “FII” and may invest in rural lands and real estate receivables related to rural land, including CRAs and CRIs; (iii) “FIAGRO-Participations” take the form of “FIP” and may invest in equity interests in companies that explore activities in the agri-industrial chain, including convertible securities. 3. Who can benefit from FIAGROs: FIAGROs can be used by Brazilians and foreigners, including (i) lenders and fintechs, as a vehicle for credit and advance of receivables, (ii) real estate investors, as an investment vehicle for acquisition of rural lands in Brazil aiming at exploration, rural partnerships, land value appreciation, etc. (observing the legal restrictions for foreigners), (iii) Venture Capital, Private Equity and investors in general, as a vehicle for equity investment in agribusiness companies, and (iv) agribusiness family groups/companies, for asset, wealth and fiscal planning. 4. Favorable Taxation of FIAGROs: in the same way as real estate funds, income distributed by FIAGROs to individual shareholders will be exempt from income tax, provided that (i) the fund has more than 50 shareholders, (ii) the respective shareholder does not holds more than 10% of the fund’s equity or earnings, and (iii) the shares are listed in exchange or over the counter. As for investments, investments made by FIAGROs in CRAs, CRIs, CPRs, CDA/WAs, CDCAs are not subject to withholding income tax. 5. Favorable Taxation in FIAGROs’ Capital Contribution: FIAGROs shares may be paid-in in cash, assets and rights, including real estate (rural land, among others). The payment of income tax arising from the capital gain on the shares paid-in with rural property by an individual or legal entity may be deferred to the date defined for the moment of sale of these shares or redemption. The volume of 20 FIAGRO operating evidences the importance of this category of funds for the market. FIAGROs will allow Brazilian and foreign investors, lenders, fintechs, insurance companies and family groups to invest and finance the sector with legal certainty and tax efficiency.

|

Dentre as novas tendências que o ecossistema de healthtechs consolidou durante o período de pandemia está o desenvolvimento de soluções com enfoque específico na saúde das mulheres, incluindo mulheres cisgênero, transgênero e não-binárias. As chamadas FemTechs vêm ganhando tração por três principais motivos:

By Mattos Filho.

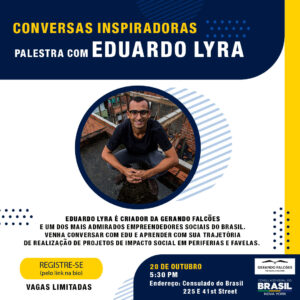

Na quarta-feira, 20 de outubro, às 5:30pm, venha ouvir a história inspiradora de Edu Lyra, o empreendedor social que tem um sonho ambicioso: transformar as favelas brasileiras em peça de museu.

Local: Consulado-Geral do Brasil em Nova York – 225 East 41st Street, NY 10017

Com apenas 33 anos, Edu Lyra já é um dos mais admirados empreendedores sociais do país. Palestrante requisitado, tendo sido convidado a falar em universidades como Harvard e Babson College e em empresas como Google, Ambev e Accenture. Lyra é fundador e CEO da Gerando Falcões, rede que viabiliza projetos de impacto social em periferias e favelas do Brasil. É uma realidade que conhece por experiência própria e que procura transformar por meio de ações mundialmente reconhecidas.

A palestra será seguida de coquetel.

Global banking leader Santander announced today the spinoff of their merchant payment business, Getnet Brazil. Beginning October 18th, Getnet will be listed on the B3 Exchange in Brazil, and on the Nasdaq beginning Oct 22nd. Santander sees the spinoff as the first step toward building Getnet into a global merchant acquiring business. Already the 3rd largest acquirer in Brazil and number one in eCommerce processing, Getnet is planning a major expansion through the LatAm regions, into the UK, and eventually the North American markets. Getnet has doubled its market share in Brazil in just 5 years, and today services more than 1.2 million merchants in Brazil, Mexico, Argentina, Chile, Uruguay and parts of Europe.

The spin-off of Getnet Brazil, which was a wholly owned subsidiary of Santander Brazil, is part of Santander Group’s plans to create a global merchant acquiring franchise under the Getnet brand as part of PagoNxt – a technology-focused global payment fintech fully owned by Santander to integrate the bank’s most innovative and disruptive payments franchises.

Don Apgar via PaymentsJournal.

Workers want more digital skills, more inclusivity, and more flexibility

In one of the largest global surveys of workers, people revealed a mostly optimistic story, but one with some concerning undercurrents. Workers reported feeling excited or confident about the future. Most said they believe they can meet the challenges of automation — and they proved it during the pandemic: by learning new digital skills and by quickly adapting to remote work. Yet many people think their job is at risk, and half of all respondents feel they’ve missed out on career opportunities or training due to discrimination.

PwC is committed to highlighting the issues surrounding the digital divide and the societal and economic benefits of greater private-public collaboration on upskilling and reskilling. There’s a lot more to do to create more diverse, inclusive workplaces that allow everyone to give their best.

By PwC.

De tendência fashion a posicionamento central de marcas globais, nos últimos anos a moda sustentável alcançou patamares comerciais sem precedentes. Segundo relatório divulgado pela empresa de pesquisa Research And Markets, o crescimento mundial do setor deve passar de 6,3 bilhões de dólares em 2019 para $8,2 bilhões de dólares em 2023. Entre 2025 e 2030, esse número pode chegar a 15,2 bilhões de dólares, mostrando que investir em sustentabilidade é bom não apenas para o meio ambiente mas também para o futuro da indústria da moda.

A Economist Intelligence Unit (EIU) aponta que as buscas na internet por produtos sustentáveis tiveram crescimento de 71% nos últimos cinco anos. Englobando mais de 54 países, o estudo aponta que, no Brasil, os tuítes relacionados ao assunto aumentaram 82% no período analisado e o volume de notícias cresceu 60%.

O interesse do consumidor por esses produtos aumenta mesmo diante dos preços mais elevados da categoria. Segundo a Futuro do Comércio, pesquisa feita pela Shopify, 53% dos entrevistados afirmaram preferir produtos sustentáveis e 75% se dizem dispostos a pagar mais por itens ecológicos.

“Com o mercado aquecido, o setor enfrenta agora o desafio para diferenciar cadeias produtivas realmente sustentáveis de ações publicitárias oportunistas”, comenta Mäby Dutra, fundadora da DaCosta Verde. Baseada em Nova York, a diretora criativa de São Paulo trabalhou para uma das maiores autoridades no assunto, a designer britânica Stella McCartney. Em 2020, abriu sua própria grife com o objetivo de expandir a moda sustentável do Brasil para o mundo. Da escolha dos materiais à embalagem, passando pela ética social, a DaCosta Verde tem sua marca alinhada com os Objetivos de Desenvolvimento Sustentável (ODS) e apoio consultivo do escritório de parcerias da ONU na campanha We Are Amazônia. Na venda de cada camiseta da linha, comercializada no Brasil, Estados Unidos e, em breve, na Europa, a marca se compromete a doar cinco árvores para a floresta Amazônica, em parceria com a ONG S.O.S Amazônia.